The Most Powerful Financial

Phygital Collection Platform

Physical

AI

Digital

Full Stack Debt Monitoring Collection and Recovery Platform

Increase in Contact Center

Reduced Calling Cost

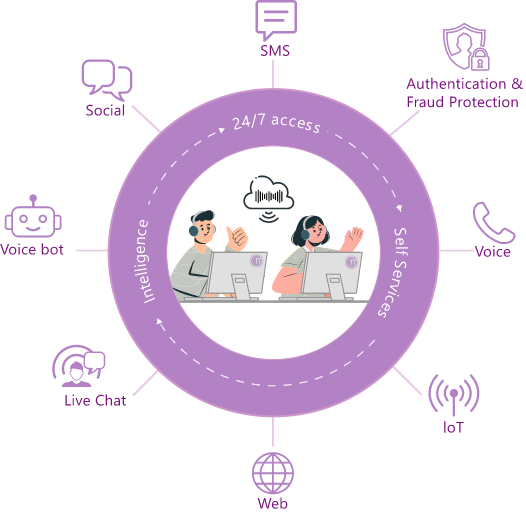

Boost the efficiency of your Pre-Delinquency and Post Delinquency Auto-Cure payments with guaranteed success based AI/ML solution. With mCollect we offer an advanced journey management engine with an omni-channel reach that empowers seamless, single-click payments directly to the loan account

Increase in Contact Center

Reduced Calling Cost

Backed by digital and AI, real-time insights to our contact center ensure higher efficiency and customer delight

Increase in Total Collection

Reduced in Pending Collection

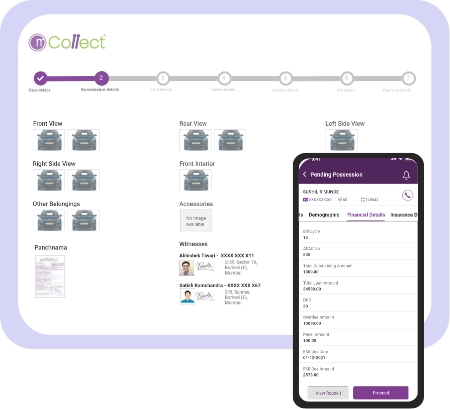

Transform your debt collection strategy with mCollect's pioneering mobile application for your field agents. Our robust software excels in managing cash and rural/agricultural portfolios, and is hardened with industry experience across portfolios. With cutting-edge mobile-first capabilities and superior third-party agency management, we offer a competitive edge in your debt collection process

Increase in Digital Communication

Reduced Calling Cost

Experience the efficiency and precision of mCollect platform in streamlining your entire debt recovery journey . Our solution provides an end-to-end workflow with a configurable approval rules engine that can be adapted to suit matrix hierarchy structures across both internal teams and third-party agencies. With our settlement and repossession software, we address and streamline critical areas of manual and unregulated processes across secured and unsecured portfolios.

Increase in Digital Communication

Reduced Calling Cost

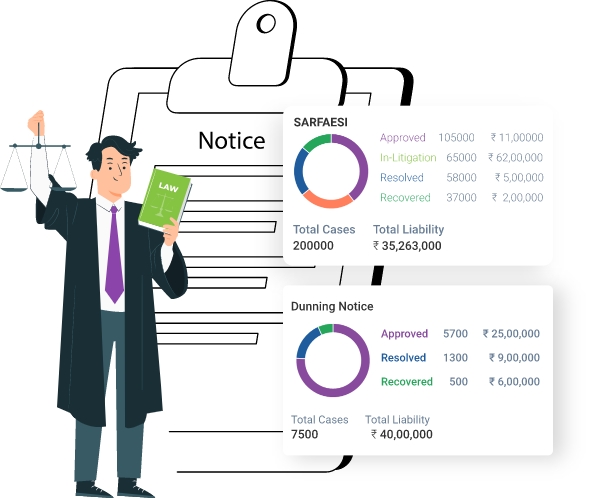

Experience the transformational shift in managing your legal and compliance processes with mCollect Legal & Compliance Module. Designed to seamlessly integrate with e-courts, e-post, and third-party forums, our module offers vertical-specific legal workflow tracking for different legal avenues, including Section 138, Sarfaesi, DRT, NCLT, and Arbitration.

Increase in Digital Communication

Reduced Calling Cost

Ring fence your legal processes and other print communications to your consumers with our pioneering single click Print-to-Post solution. This first of its kind innovation is built with a single goal to bring security and compliance from data origination to the post office.

Digital Debt Collection Trusted by Marquee Leaders

Efficiently allocating your resources in debt collection can enhance your recovery process reducing the overall cost of debt collection.

Use of digital collection mediums like debit cards, online payments, accountability

Centralized and online allocation of customers helps in increasing efficiency by automating the manual processes such as sending reminders, tracking payments, and generating reports.

Better customer satisfaction with increased transparency in services like spot

Tailored communication and nudges based on customer score card. Faster collection of dues.

Early warning signs of delinquency based on external parameters. Contextual notifications and alerts.

Powerful rule engine with flexibility to define complex rules. Allows configuration rules on your business specific data flags. Automate end to end allocation of cases directly to collection executive.

Industry leading true-blue ML golden model built on data analysis across financial institutions and demographics. Define rules based on prescriptive analysis to implement your desired collection strategy.

Use the power of Digital reach with our Omni-channel digital collection platform with iterative, contextual and self-learning models.

You focus on your business and allow us to handle your digital collections end to end with our all encompassing click to pay platform with real time credit update. (UPI/QR, Debit Cards, Internet Banking, AEPS, BBPS, Debit POS)

Increase the efficiency of your existing call centre team by integrating their feedback and pick-up request to give you a holistic view on any case progress.

Our battle hardened Field App proven to be quickly adopted by field teams. Intuitive and easy to use features with a task breakdown structure.

Single window view of customer across loans and for a specific loan all communications, feedback and past history.

Collect cash and payment instruments seamlessly with strong fraud prevention and real time and transparent multi-level deposition workflow.

Tag transactions, build intelligence and location aware allocation of cases based on historical location data.

Web hooks / APIs to integrate your internal and external systems Credit Bureau, NSDL(PAN), Core Banking, e-NACH, e-Court, e-Post, GST, Vahan.

Settle-on-the-go with capability of field teams to raise settlement and collect instantly against sanctioned and approved settlements.

Industries leading asset repossession module with approval workflow and integrated field app. Tailored to needs of both movable and immovable assets.

Legal and Litigation at the right time with portfolio specific pre-built workflows. Bring in full case visibility, centralization and collaboration with external agencies.

The task of printing, packaging & posting, tracking & recording the communication today is a highly disjointed process leading to inefficiency and consumer data exposure risks.

Bank grade security with transparency and making it easier to adhere to regulatory compliance with a commitment to pre-build all upcoming compliance requirements.

Our Managed Infrastructure Services provide comprehensive infrastructure management and proactive monitoring of the mCollect deployment on-premises, or over the cloud. We will ensure the resilience and optimal performance, so you focus on delivering organizational outcomes.

While Analytics and Dashboards give you what has happened we will give you real time KPI visibility, governance and to improve performance use our Gamification module and Leaderboards.

Inbuilt AI based document scanning & Verification, so no more mistakes. Payment instruments can be clicked and scanned by NetraScan plug-in. Bring in more security and compliance with Digital Id and Face match capabilities, for safely on-boarding customers, agents and agencies.

Built by real industry domain experience across leading financial institutions spanning a decade.

Debt collection and recovery solutions are essential for any lenders as they solve industry- specific challenges, focusing on recovering debt promptly with efficiency and offering smart solutions on how to navigate the different complexities associated with it. With Mobicule’s Full-Stack Debt Resolution solution mCollect, take advantage of latest technologies to streamline your Debt Collection & Recovery process. Debt collection is one of the most important elements for banks and financial institutions in order to recover the outstanding loan. In brief, debt resolution solutions represent the most important tool in the process of managing and overcoming the problem of debt collection across several industries.

Mobicule Technologies is a 16-year mature organisation which has provided Full-Stack solutions in Debt Collections & Recovery to marquee and trusted banks and NBFCs through its cutting-edge technology and AI/ML model-based debt resolution solutions. The platform has integrated with cutting edge technology to deliver insights-driven engagements and tailoring effective debt collection & recovery strategies.

We started Mobicule

Years of industry experience

Satisfied customers

Locations

In an interview with ET BFSI for the CXO Conclave 2024, Siddharth Agarwal, Founder and MD of Mobicule Technologies Pvt. Ltd., emphasized the critical role of risk mitigation in shaping effective debt collection strategies. He highlighted the integration of early warning systems within banks and NBFCs as a key component in mitigating financial risk and enhancing collection efficiency.

Watch Now

In an interview with ET BFSI for the CXO Conclave 2024, Chandra Mouli, Chief Growth Officer of Mobicule Technologies Pvt. Ltd., discussed the essential role of risk mitigation in debt collection has become a critical focus for organizations aiming to safeguard financial health of the organization.

Watch Now

Tune in to the latest episode of ELI's podcast featuring Siddharth Agarwal, Founder & Managing Director of Mobicule Technologies Pvt. Ltd., as he discusses "Revolutionizing Debt Collection with AI: Mobicule’s Unique Approach."

Watch Now

Chandra Mouli, Chief Growth Officer

New Delhi [India], As 2024 draws to a close, leaders from diverse industries have shared their reflections on the year gone by and their outlook for 2025. The year has seen both resilience and growth across sectors, from real estate to technology, education, and industrial manufacturing. With advancements in sustainability, technological integration, and economic recovery driving sectors forward, industry experts are optimistic about the future.

New Delhi [India], December 28: The Future Leaders of 2025 spotlight the trailblazers shaping tomorrow's world. These visionary individuals are redefining innovation, sustainability, and leadership across industries. From driving impactful change in technology and healthcare to championing climate action and social entrepreneurship, these leaders represent the voice of a dynamic generation. As they carve unique paths, their groundbreaking efforts inspire transformation on local and global scales.

Prasad Patil, CTO & Chief Business Operations

When the face of technology is about changing the world around us, no business or industry remains untouched. The debt resolution industry is no exception. Innovations of AI voice bots will change the way we encounter and manage the loan recovery process. Check out the below article to understand how AI voice bots in the collection & recovery landscape are now a game-changer for banks and financial institutions.

Spandana deploys Mobicule’s NetraScan to Secure over One Crore Customer KYCs in Rural India

Mobicule Technologies, a leading digital AI based customer onboarding, has partnered with Spandana Sphoorty Financial to enhance customer acquisition and document processing.

Spandana deploys Mobicule’s NetraScan to Secure over One Crore Customer KYCs in Rural India

Mobicule Technologies, a leading digital AI based customer onboarding, has partnered with Spandana Sphoorty Financial to enhance customer acquisition and document processing.

If you’re passionate about technology and believe in the positive impact of technology that can make to business process which impact the consumers, Mobicule technology is the right place to be. Explore the exciting career opportunities and be part of the pioneering journey.